straight life policy formula

It is also known as ordinary life insurance or whole life insurance. Unlike the other benefit options straight life has no provisions for extending annuity payments to a beneficiary or survivor for an exception see the section on changes in marital status below.

Alkanes Study Chemistry Chemistry Lessons Chemistry Help

With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax.

. The goal of a permanent policy is to have life insurance in place for the rest of your life. Cost of the asset is the purchase price of the asset. This difference is sometimes called the depreciable base.

Updated last on January 31 2022. Such type of insurance helps your family prepare for the sudden. It is also known as ordinary life insurance or whole life insurance.

Other permanent life insurance plans such as adjustable life insurance can have a premium structure that changes over time. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest goes to the cash. A straight life annuity is tax-advantaged just as other annuities.

The term straight refers to the whole life insurance policys premium structure. The guaranteed death benefit can help replace a familys. The depreciation amount is the same every year.

Straight life annuities do not include a death benefit so payments cant be made to a beneficiary. Updated Oct 15 2021. Straight life policies are often expensive and therefore.

Shop The Best Rates From National Providers. Straight life insurance is a type of permanent life insurance. Comparisons Trusted by 45000000.

Salvage value is the value of the asset at the end of its useful life. Straight line depreciation method charges cost. First the difference between the purchase price of the asset and the salvage value is calculated.

12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. The assets life expectancy is 20 years with 1500 as the estimated salvage value. 1 8 x 100 125 per year.

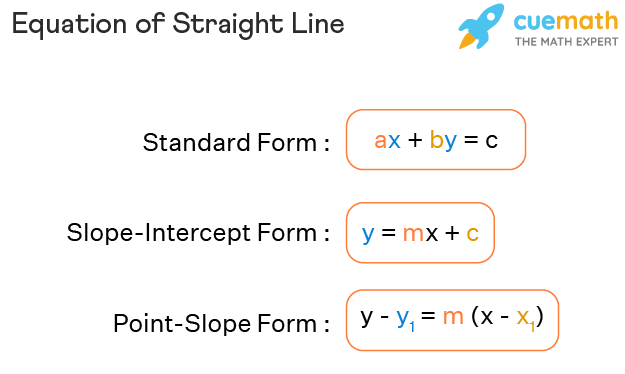

Straight-line Method Formula Depreciation Expense Cost Salvage ValueUseful life Cost. A straight life insurance policy is one that provides lifelong coverage at a consistent premium rate. Rate of depreciation.

Because the payouts will be shorter in duration they offer the highest periodic. A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy. Rate of depreciation is the percentage of useful life that is consumed in a single accounting period.

The difference is then divided by the assets expected life to find the annual depreciation expense amount. A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. International Risk Management Institute Inc.

Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums to the plan. The result is a. The straight line depreciation formula for an asset is as follows.

A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. Ad Over 12 Million Families Trust SelectQuote To Find Their Life Insurance Policy. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefitLike all annuities a straight life annuity provides a guaranteed income stream until the death of the annuity owner.

A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single lump-sum payment. On the death of the retiree the monthly payments end. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

Ad Find The Best Life Insurance Policy in 2022. These policies are more expensive. A straight life policy will build cash value over time as you continue to pay your premiums.

A straight life policy is not a good idea if you need short-term coverage. While more expensive than term life insurance straight life insurance offers the opportunity to build cash value. A straight life insurance policy can also build cash value over time.

The rate of Depreciation Annual Depreciation x 100 Cost of Asset. Rate of depreciation can be calculated as follows. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

The straight life option pays a monthly annuity directly to the retiree for life. Better known as whole life insurance. A straight life annuity is tax-advantaged just as other annuities.

However most people pay taxes in retirement because of this. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the duration of the policy. Both depreciation and amortization apply the same concept.

Acquisition cost Salvage value Service life years. Useful life of asset represents the number of periodsyears in which the asset is expected to be used by the company. Rate of depreciation of an asset having a useful life of 8 years is 125 pa.

Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation amount. Straight Line Depreciation Formula. The result is a faster growth of your account value.

Straight life insurance is more commonly known as whole life insurance. February 27 2022. SelectQuote Rated 1 Term Life Sales Agency.

In short yes. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

Depreciation Calculation Fixed Assets Presentations Only Course 100 Off Fixed Asset Bookkeeping Course Business Courses

F1 2020 Pc Digital Download 14 99 Frugal Gaming Digital Edition Download Games

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Depreciation Formula Examples With Excel Template

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Interact Quiz Review Using Quiz Software For Better Lead Generation Lead Generation Lead Generation Marketing Generation

Two Point Form Formula Derivation Examples

3d专家预测最准今天 官网 Baby Breastfeeding Baby Milk Newborn Baby Care

Equation Of Straight Line Forms Formula Examples What Is Equation Of Line

Pin By Tanya Indira On Formula 1 Formula 1 F1 Motorsport Formula One

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

May The Force Be With You Star Wars Shirt Funny Science Etsy In 2022 Funny Science Shirts Science Shirts T Shirt

Domain Knowledge Enterprise Architecture Domain

Baby Questions Answered Simply Feeding Baby Solids How Much Formula Solids For Baby

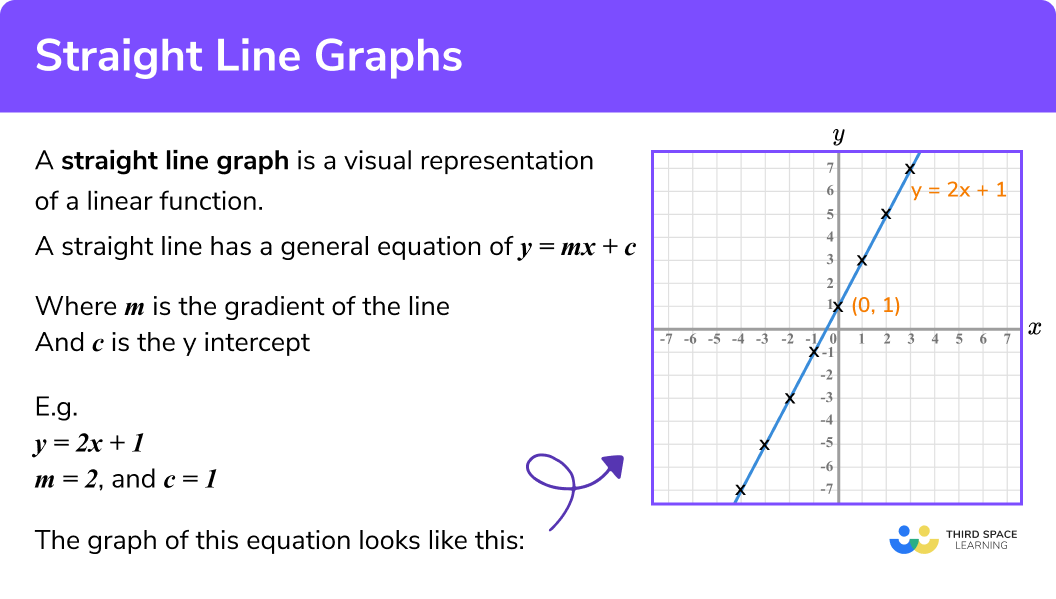

Straight Line Graphs Gcse Maths Steps Examples Worksheet

Bottle Feeding Moms Breastmilk Or Formula Feel More Judged Every Time They Pull Out A Bottle In Public Than Yo Breastfeeding New Baby Products Bottle Feeding

The Best Beauty Products You Can Buy From Your Friends Rodan And Fields Life Changing Skincare Rodan

A Detailed Guide To Help You Find The Healthiest Safest Organic Formula For Your Baby With What Ingredient Baby Formula Organic Baby Formula Organic Formula